During McCuistion TV’s episode on Corporate Governance and its impact on China and the world, they address three questions related to the credit crisis and corporate governance:

During McCuistion TV’s episode on Corporate Governance and its impact on China and the world, they address three questions related to the credit crisis and corporate governance:

– How do the Chinese see our economic situation?

– How has trade impacted what multinationals do?

– How has American economic and foreign policy impacted the rest of the world?

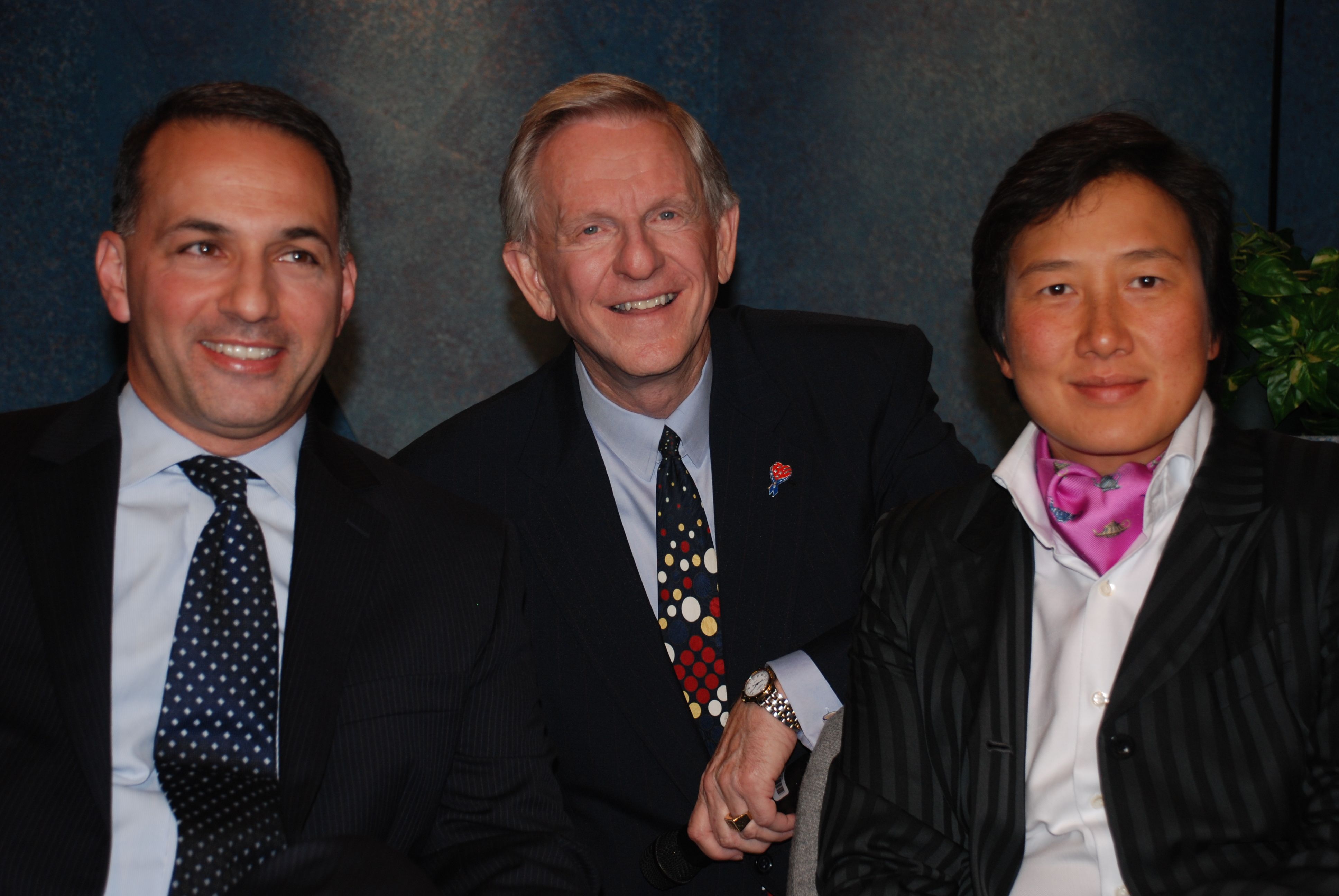

Guests include:

Angelina Kwan: Managing Director and COO, Asia Pacific, Cantor-Fitzgerald

The Hon. Mario Mancuso: Partner, Akin Gump Strauss Hauer & Feld, LLP, Former Under Secretary of Commerce

One of the points that host, Dennis McCuistion, addressed was that by-and-large we as a society do not often talk about China when discussing the American credit crisis and corporate governance, although it does impact them. He asked Angelina Kwan for her perspective.

Ms. Kwan believes that,

“The US is China’s best past and present trading partner. China wants a strong dollar. China really thinks that America has a great entrepreneurial spirit and it will get out of the current trade deficit.”

Ms. Kwan states that China will continue to work with the US and not in an adversarial role, but first and foremost as trading partners.

Dennis agrees, “We, the US and China, need each other. China is the largest creditor of the United States. We need to both figure out how they [China] will get paid.” Angelina Kwan tells us that the US needs to look at how it’s dealing with their dollars and its fiscal policy. China and the US are having serious discussions about China exporting less and the US having less dependency on exports and not relying so heavily on Asia and China.

The guests agree that trade is good for both partners. Mario Mancuso adds,

“A prosperous China is in the best interests of the United Sates and vice versa. Both being prosperous is in the global interest. These are the two largest economies in the world, and we agree on our ultimate objectives. We just can’t figure out how to implement those objectives- that’s the irony.”

He tells us, 95% of our customers are outside the US and if we build a wall, we close competitors out.

“A rules-based trading system is advantageous to competitive parties and the US is the most competitive in the world.”

US consumers benefit with better products at cheaper prices…

“An additional point, I take a backseat to no-one in terms of levying criticism, at the same time I don’t think the final chapter has been written on US economic leadership.”

And a special thank you to the Institute for Excellence in Corporate Governance,University of Texas at Dallas, School of Management, (http://som.utdallas.edu/iecg/) for providing the guests for this 4 part series on Corporate Governance.

And a special thank you to the Institute for Excellence in Corporate Governance,University of Texas at Dallas, School of Management, (http://som.utdallas.edu/iecg/) for providing the guests for this 4 part series on Corporate Governance.

Tune in for the rest of the story as continue to talk about things that matter with people who care…

Niki Nicastro McCuistion

Executive Producer/Producer

***

1809 – 11.22.09